Contents:

In the case of the realization principle, performance, and not promises, determines when revenue should be booked. According to the realisation concept, the revenues should be realized or recorded at the time when the goods or services have been delivered to the purchaser. Here, the transaction is being recorded based on the transfer of goods/services from the seller to the buyer and not based on the transfer of risk and rewards. This realization principle has been the foundation of the accrual basis of accounting which presents a similar concept. If services are to be rendered at a point in time the revenue is recognized as soon as the services have been performed.

There’s no way to tell if a larger space or better location improves revenue. There is no direct relationship between these factors and a new building. Because of this, businesses often choose to spread the cost of the building over years or decades. Yeah both of these concepts are used in the accrual accounting and not in the cash accounting. Arrangement, the first condition, dictates that there needs to be an agreement between two parties in a transaction.

The revenue recognition principle is another accounting principle related to the matching principle. It requires reporting revenue and recording it during realization and earning. In other words, businesses don’t have to wait to receive cash from customers to record the revenue from sales. In other words, revenue will not be treated as earned unless a sale actually takes place and payment is either made or deferred against a claim . This concept prevents an entity from posting profits on pending transactions or events. For example, revenue is earned when services are provided or products are shipped to the customer and accepted by the customer.

What Is Revenue Recognition Principle?

The business then disperses the $20 million in expenses over the ten-year period. If there is a loan, the expense may include any fees and interest charges as part of the loan term. This disbursement continues even if the business spends the entire $20 million upfront.

When is revenue recognized under accrual accounting? – Investopedia

When is revenue recognized under accrual accounting?.

Posted: Sat, 25 Mar 2017 06:59:04 GMT [source]

This what is an enrolled agent received an advance of $10,000 on the purchase on September 15, 2021. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. As another example, consider that Mr. A sells goods worth $2,000 to Mr. B. The latter consents that the goods will be transferred after 15 days. Upon receiving the goods, Mr. B makes the payment after 10 days.

Identify 6 accounting concepts and explain them give two examples of each. Through realization principles, the inflation of revenue and profits can be controlled. It ensures a true and fair view of the accounts as profit is to be realized and recognized only when the seller transfers risk and rewards. So, according to the recognition principle, the revenue of trucks is to be recognized when risk and rewards related to the truck are transferred, or the truck is delivered, whichever is earlier.

What Is Accounting Standards Codification (ASC) 606?

Businesses and clients need to adhere to the standard procedure before they can recognize revenue. Of course, the best evidence of an arrangement is a client paying cash for goods or services. Simply omitting the figure from the financial statements is not accurate either.

- In this second example, according to the realization principle of accounting, sales are considered when the goods are transferred from Mr. A to Mr. B.

- These principles are not used in cash accounting because the sale of a product or service or the earning of Revenues may not necessarily be through a Cash transaction.

- Describe the role of the various stakeholders in developing accounting standards.

- Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

They assure uniformity and understandability.Accounting principles are Generally Accepted Accounting Principles , which guide all accounting users when interpreting accounting data or information. Certain financial elements of business also benefit from the use of the matching principle. The matching principle allows distributing an asset and matching it over the course of its useful life in order to balance the cost over a period. In a cash business, revenue may be realized immediately as it comes in. However, in SaaS companies, realization is the ratio of how much of a Sales deal or commitment has been recognized as revenue. Essentially, revenue realization is defined as sales converted into revenue.

What Is the Matching Principle and Why Is It Important?

Discover the principles of basic accounting and learn essential accounting terminology. Explore examples of these accounting terms in real-life situations. In the above case, the sale of the truck is related to the sale of goods, and the maintenance contract is the continuous service to be provided to the customer for a one year period. This means if a business receives an advance, and they have not yet delivered or transferred the goods, the revenue should not be recognized. Revenue or income should be recognized when it is earned, whether the cash has been received or not.

- True revenue earned during the year is given importance and recognition instead of revenue collection.

- For example, revenue is earned when services are provided or products are shipped to the customer and accepted by the customer.

- Accounting principles are intended to make accounting an objective process.

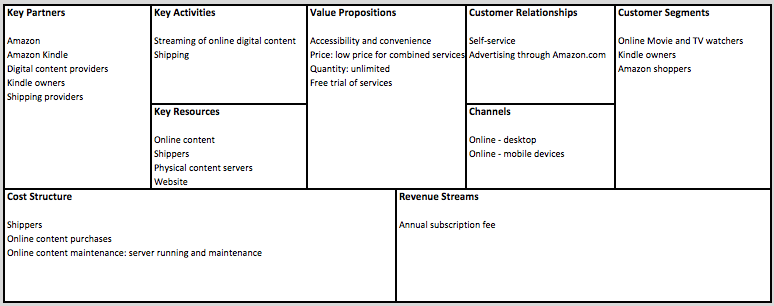

- For example, in a SaaS company, revenue would be from the sale of monthly or annual subscriptions.

- The purchase of inventory, payment of a salary, and borrowing of money are all typical transactions that are recorded by means of debits and credits.

Is it logical for an owner to allow personal preferences to influence a decision about business location? When is franchising appropriate (from the business owner’s point of view)? Provide an example of when franchising is appropriate and when it is inappropriate.

So in the case of Plants and More, since they will be providing service to Ben’s Burgers continuously for a year, the revenue will be recognized using the percentage completion method. The realization principle explains when revenue should be recognized. The revenue has to be recognized when it is realized, not when an order is received. A seller ships goods to a customer on credit, and bills the customer $2,000 for the goods. The seller has realized the entire $2,000 as soon as the shipment has been completed, since there are no additional earning activities to complete. The delayed payment is a financing issue that is unrelated to the realization of revenues.

How to Build a Revenue Operations Strategy That Will Grow Your Company

With the IFRS 15 – https://1investing.in/ from contract with customers comes to effect, the revenue recognition has been divided into five steps called five steps model. Payment is made here for past work so this cost represents an expense rather than an asset. Thus, the balance recorded as salary expense goes up by this amount while cash decreases.

Such assets comprise stocks, commodities, market indices, bonds, currencies and interest rates. The revenue should be recognized once the business does transfer the goods. This is the point at which a business can reasonably expect that the customer will pay for the goods or services. Recognize revenue when the performing party satisfies the performance obligation.

Breaking Down The Tax Changes In The Inflation Reduction Act – Forbes

Breaking Down The Tax Changes In The Inflation Reduction Act.

Posted: Tue, 16 Aug 2022 07:00:00 GMT [source]

1In larger organizations, similar transactions are often grouped, summed, and recorded together for efficiency. For example, all cash sales at one store might be totaled automatically and recorded at one time at the end of each day. To help focus on the mechanics of the accounting process, the journal entries recorded for the transactions in this textbook will be prepared individually. Businesses primarily follow the matching principle to ensure consistency in financial statements. The principle is at the core of the accrual basis of accounting and adjusting entries.

Matching Principle

Are you fully realizing all of your sales deals on your income statement? Revenue realization and revenue recognition are two different events that impact your ability to accurately forecast and reflect on the true earnings in a period. However, there are exceptional cases where this concept doesn’t hold. For example, revenue is recognized before completion of the work in a long term contract work-in-progress.

Revenue recognition principles within a company should remain constant over time as well, so historical financials can be analyzed and reviewed for seasonal trends or inconsistencies. SaaS businesses use the accrual-basis accounting method to differentiate between revenue realization vs revenue recognition. There are specific terms they have to meet before the figures can be counted toward contributing to the bottom line. Knowing what these are gives the business a better overview of its actual health along with projecting it to plan for the future. Explain how previous pension accounting standards were based on a revenue-expense approach to the financial statements.

Explain the notion that accounting is not only socially constructed but also socially constructing . Discuss briefly the concept of normative accounting theory. Describe two main concentrations of normative accounting theory.

This provides a more accurate overview of the financial health of the business. To remedy inaccurate health views, in our $1,200 annual subscription, $100 is recognized monthly for the 12 months. For example, payment of a Toyota car is made in full on 5th March 2022 but the car is delivered on 15th March 2022. Write a Summary on how management Cost Accounting Information Creates Values, explaining key terms and concepts.

The seller does not realize the $1,000 of revenue until its work on the product is complete. Consequently, the $1,000 is initially recorded as a liability , which is then shifted to revenue only after the product has shipped. Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience. Timothy has helped provide CEOs and CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and financial models. Verifiable Objective Evidence Principle-under this principle, accounting data must be verified. Full Disclosure Principle-this principle guides on matters of information significance.

The Russo-Ukrainian War and the Principles of Urban Operations – smallwarsjournal

The Russo-Ukrainian War and the Principles of Urban Operations.

Posted: Thu, 10 Nov 2022 08:00:00 GMT [source]

Revenue from construction contracts must be recognized on the basis of stage of completion. Contractors PLC entered into a contract in June 2012 for the construction of a bridge for $10 million. The total costs to complete the project are estimated to be $6 million of which $3 million has been incurred up to 31st December 2012. Contractors PLC received $2 million mobilization advance at the commencement of the project. The true and fair view is better reflected in the realization concept.